Developing a sharp focus on a specific market segment and clearly differentiating its innovative device from the competition helped boost the sales and marketing efforts of the company, which ultimately led to its acquisition.

While focusing on growth is a natural development phase for startups, it can be difficult for more established companies to inject the fresh strategic approach often required to better position themselves for growth.

A long-time player in the EBD (Energy-Based Devices) aesthetic market approached Forabilis because it was struggling to build an effective go-to-market strategy to scale.

Product Differentiation is Key to Proper Positioning

The Israel-based company, active globally, including the US, EMEA and APAC, had developed a unique device using proprietary Kinetic technology. Initially, its technology had gained interest from physicians, partners and media. However, it was finding it difficult to commercialize this interest.

The device was not well differentiated and was being marketed for multiple applications, including the reduction in the appearance of aged and dry skin, neck lines, acne and atrophic scars, stretch marks and more. With the energy-based aesthetic devices market forecast to grow from $2,661.6 million in 2021 to reach $6,326.2 million in 2030, this EBD manufacturer wanted to refresh its strategic approach to ensure it was well positioned to win market share.

Identifying Strategic Challenges

As a first step, we dove deeply to understand the current status of the company, product and technology. Very quickly we identified multiple challenges which posed as gaps in the ability of the company to scale. Among these challenges were the following:

- GTM strategy – misalignment between sales, marketing and clinical activities leaving initiation to distributors and KOLs

- Market-fit – lack of clear and differentiation-based positioning: solution sold for various indications without a strong claim

- Clinical – insufficient and unfocused clinical evidence and clinical protocols

- Regulatory – insufficient and inconsistent regulatory clearances in key markets

- IP – loopholes in the IP registration in key markets

- Operations – ongoing unaddressed technical issues and sourcing challenges

- Business – lack of business model optimization leading to high cost of ownership

Focusing on Strengths and Differentiators

We interviewed key stakeholders, including KOLs (Key Opinion Leaders), investors, partners and employees, to get an even deeper understanding of the product’s strengths and its underlying unique technology and its current marketing and sales efforts.

The next step was to understand the market and how the product could differentiate itself from other available solutions. Aside from analyzing the competitors, we were looking to understand the drivers and limiters of the company and its growth potential in a specific market. We also conducted research to understand the market opportunities and identify potential unmet market needs for which the company’s technology could act as a beneficial solution.

Our overall findings showed the company was currently relying on unsustainable sales with no ability to scale following initial penetration. The sales were ad-hoc with no overarching strategy. There was also no control over the sales process and the product’s positioning with no clear commercialization plan and tools.

Identifying a Profitable Market Where Differentiators/Strengths Have Impact

Following intensive research, we provided clear recommendations based on a new approach that addressed the challenges we identified. Key to this was the identification of a strong market opportunity for the company and its stakeholders to pursue. This would allow the company to leverage specific assets of the company and its technology to focus on a unique market need with a strong business potential.

This enabled the company to claim stakes on the market segment where they would have a clear competitive advantage. In addition, we helped identify a strategy and territory, which had a huge market potential, where the company’s regulatory clearances already existed and was an untampered market.

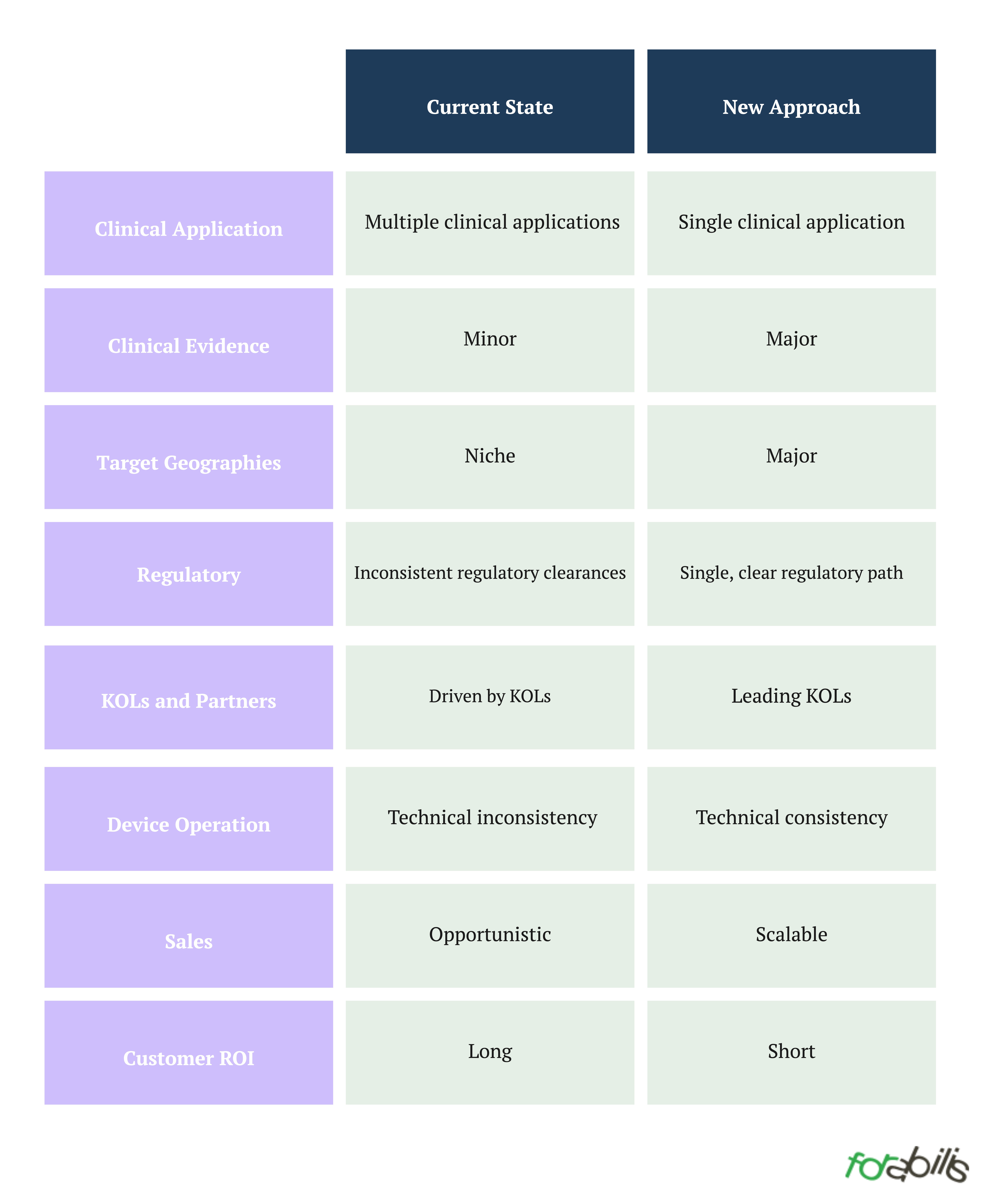

Our approach spoke of a complete repositioning of the company and its offerings:

Building a GTM to Successfully Reposition

Following our conclusions, we developed an initial validation plan, including timeline and budget. This was to ensure a clear alignment between market needs and company’s capabilities to fulfill this need.

Next, we identified the new positioning and marketing messages, and developed a holistic tactical marketing plan which also included timelines and budget. This had a significant impact on the company as it focused its product and its benefits directly towards a specific niche in the market.

The company’s product had suffered from a lack of differentiation as it targeted a whole set of market categories and needs. Now its focus, for the first time, was clearly defined. The result was that conversations with partners and potential customers progressed far quicker and deeper as the benefits and market niche of the product were clear.

The fact that the company’s product and technology was proving to be a superior solution in this well defined market segment meant that within 18 months of our start date, the company was acquired by a leading player in the Aesthetic world.

The lesson here is that positioning matters. Products cannot be all things to all people. The better a company defines its product, targets a specific market and effectively communicates its solution, the more successful attempts at scaling will be.

Are you having difficulties scaling? We are here to help.